It’s difficult to look at Nvidia’s trajectory and see anything but a vertical line. The company, which recently breached a $3 trillion market capitalization, has become the de facto engine of the artificial intelligence revolution. Its stock chart is a monument to market euphoria. Investors seem to have priced in not just current dominance, but perpetual, unassailable dominance for the foreseeable future.

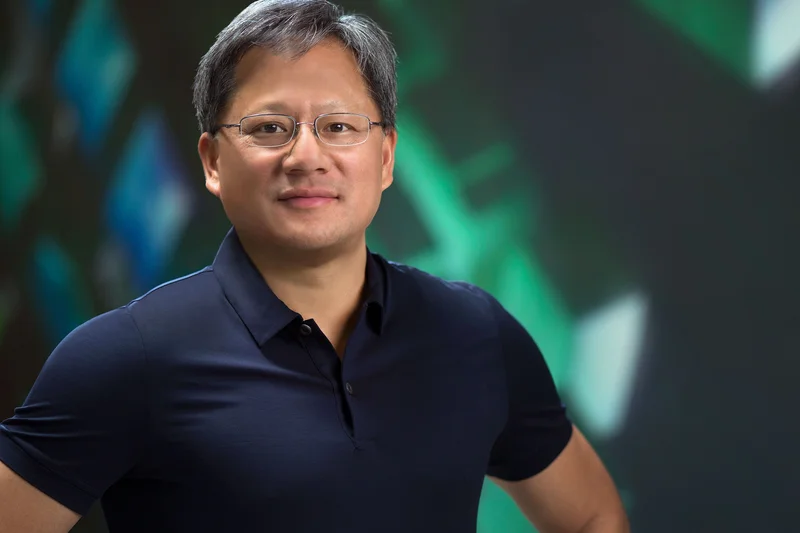

And then you have the company’s CEO, Jensen Huang, on a stage, in his signature leather jacket, essentially telling everyone to calm down.

In a recent address, Huang issued a stark warning about a competitor that the US market has, for the most part, written off: Huawei. He didn’t mince words. "It is foolish to underestimate the might of China and the incredible, competitive spirit of Huawei," he stated. This wasn't a throwaway line. It was a deliberate, calculated statement from the man with the clearest view of the entire global semiconductor landscape. The discrepancy between the market’s valuation of Nvidia and Nvidia CEO Jensen Huang sends stern ‘Huawei’ warning: ‘It is foolish to…’ presents a puzzle. And when there's a puzzle in the data, my job is to try and solve it.

The Signal in the Noise

Most CEO commentary about competitors is corporate boilerplate. It's a mix of generic respect and confident assertions of one's own superiority. Huang’s comments were different. They were specific, almost laudatory. He praised Huawei’s technical prowess (specifically their 5G dominance and the CloudMatrix AI system), calling them a company with "extraordinary technology."

I've analyzed dozens of CEO transcripts, and this level of specific, unsolicited praise for a direct, state-backed competitor facing severe US sanctions is highly unusual. It's not just boilerplate. It’s a signal. Huang is communicating something that the stock price isn't reflecting: the race for AI supremacy isn't a single global sprint; it's bifurcating into two separate, parallel tracks.

Think of it like this: Nvidia is the Formula 1 team that has perfected its engine, aerodynamics, and pit crew to an astonishing degree. It's setting lap records on every known circuit. The market sees this and assumes it will win every race, forever. But Huawei, after being barred from competing, isn't just sitting in the garage. It's building an entirely new racing league, with its own tracks, its own engine specs, and its own rules, all within a protected ecosystem. Huang isn't just acknowledging a rival car; he's acknowledging the construction of a rival circuit where his team may not even be allowed to compete. He knows that while Nvidia is winning the current championship, another one is being created from scratch, and its champion will be formidable.

This isn't just about one "amazing" chip. Huang’s praise for CloudMatrix, Huawei’s large-scale AI supercomputing system, is the key. It demonstrates that Huawei isn't just a component manufacturer; it's a systems integrator capable of building the entire stack, from silicon to software. The US ban, intended to cripple the company, seems to have inadvertently forced it to become vertically integrated out of necessity. So, while Nvidia is "miles ahead" on the current track, what happens when a significant portion of the global market moves to a track where Nvidia's advantages are nullified by policy?

The $200 Billion Paradox

This brings us to the most interesting part of Huang’s commentary: the numbers. He described the market opportunity in China as "probably $50 billion this year." He then projected it could be worth "a couple of 100 billion dollars by the end of the decade." A massive, growing market. Yet, in almost the same breath, he delivered the punchline: "China doesn't want H20 or any American chips."

Read that again. The CEO of the world’s most advanced chipmaker identifies a market potentially worth over $200 billion and simultaneously states that this market fundamentally does not want his product. This isn't a sales pitch; it's a geopolitical and economic reality check. He’s acknowledging that US national security controls, combined with China’s aggressive push for technological self-sufficiency, have created a permanent schism.

The so-called "China-compliant" chips Nvidia developed, like the H20, were a strategic attempt to thread a needle—to sell powerful-enough-but-not-too-powerful hardware that wouldn't violate US export controls. Huang's statement is a quiet admission that this strategy may be failing. He says China has "plenty of AI technology" of its own, effectively answering the national security question from the other side of the Pacific. Beijing isn't just accepting a lower-tier chip from an American firm as a stopgap; it's signaling that it prefers its own homegrown solutions, even if they are a generation behind for now.

This presents a fundamental paradox for investors. How can you model a $200 billion addressable market that has an explicit, state-driven policy to exclude your product? Is that figure a measure of the opportunity Nvidia is losing, rather than the one it stands to gain? The details here remain scarce, but the implication is that the total addressable market for Nvidia may be significantly smaller than a simplistic global calculation would suggest. The market is pricing in world domination, while the CEO is carefully outlining the borders of his empire.

A Tale of Two Trajectories

The market is a discounting mechanism, and right now, it is discounting the Huawei threat to near zero. It sees a $3 trillion behemoth and a sanctioned, struggling competitor. Jensen Huang, however, sees the raw inputs: a nation of 1.4 billion people, a flood of state capital, immense political will, and a company with proven engineering prowess. He isn't looking at today's stock price; he's looking at the long-term resource allocation problem.

My analysis suggests that Huang's warning isn't for his employees or for policymakers in Washington. It's for the market. He is publicly managing expectations in the only way he can, by laying out the facts as he sees them. The narrative of Nvidia's unstoppable global conquest is clean, simple, and incredibly profitable. The reality—a messy, politically fraught, and geographically fractured market—is far more complex. The disconnect between these two stories is where risk resides. And it seems the CEO is more aware of it than anyone else.